Photo: Epex Spot

Over the weekend electricity producers on power exchanges across Europe were offering to pay up to EUR 500 per MWh to whoever would take their electricity. The record negative prices – a situation where producers offer to pay consumers for the electricity they use – reflect the dynamic changes brought about by renewable energy sources and reveal that European countries are unprepared to utilize the full potential of wind and solar. Changing that situation, according to experts who spoke for Balkan Green Energy News, requires flexibility markets or flexible consumption models and energy storage capacities. Even though power exchanges in the Western Balkans currently do not allow for negative prices, this will eventually happen, making the same solutions necessary in this part of Europe as well.

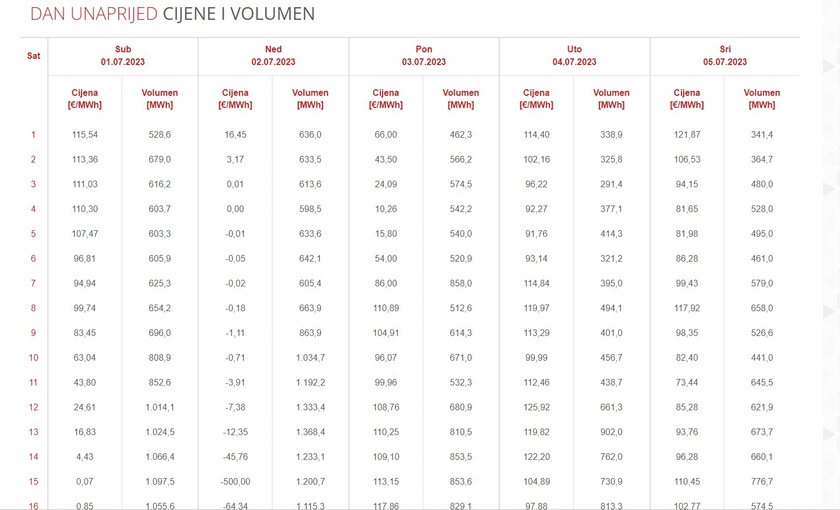

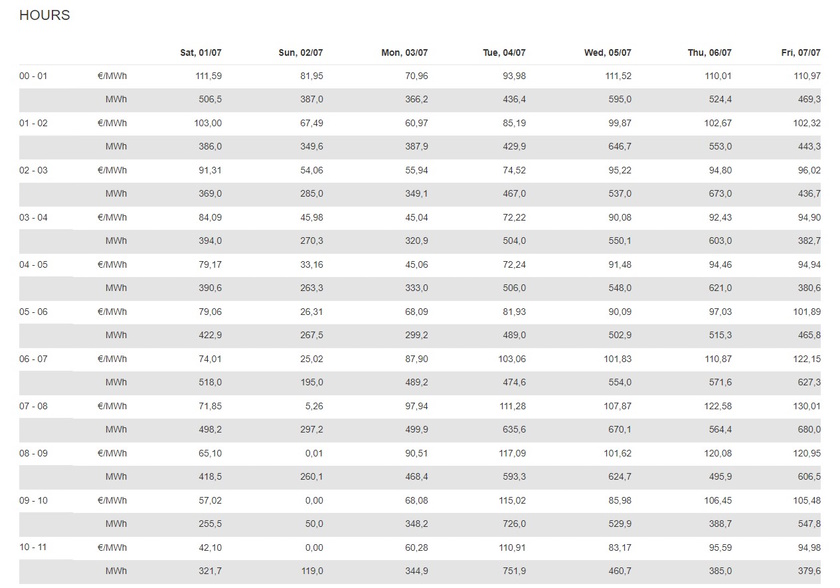

The negative power prices on Sunday, July 2, reached EUR 500 per MWh, the maximum allowed under European Union (EU) regulations.

These are, of course, wholesale prices and short periods, so retail consumers cannot profit from them, but that does not mean that they, and all other consumers and producers, will not benefit in the future, when models are in place for green energy to be immediately used or stored.

KOER: Negative prices reflect the dynamism brought by renewables

Representatives of Croatian firm KOER, the aggregator that launched the first virtual power plant in the country, said that incredibly low, even negative prices were recorded on Sunday, thanks to the high output from solar and wind.

At the Croatian power exchange CROPEX, the lowest price was minus EUR 500 per MWh, while for a total of 15 hours the prices were zero or below zero.

A similar trend was seen on the markets in Austria, the Netherlands, Hungary, Germany, and Slovenia, where electricity prices were minus EUR 500, while Belgium, France, the United Kingdom, and Switzerland recorded unusually low prices.

This, according to KOER, highlights the power of renewable energy sources to influence the market. “Although this day may seem like an anomaly, it is certainly an indicator of the dynamism that renewable energy brings to the energy market,” KOER representatives stressed.

The monthly report by Slovenian company Interenergo on price trends shows that the increased solar capacity has pushed up the number of hours with negative prices. In Germany alone, prices were below zero for 25 hours during the first seven days of July, or 15% of the time, the report added.

Negative clearing prices on electricity wholesale markets aren't a new phenomenon. They've been around since 2008 … pic.twitter.com/FIRLoZ9LfN

— Lion Hirth (@LionHirth) July 5, 2023

Pregl: The main issue is lack of flexible markets and storage

Asked what caused the negative prices across Europe, Miha Pregl, Director of European Electricity Markets at the United States Energy Association (USEA), says that negative prices are really rare, especially the EUR 500 threshold. “Since reaching the threshold is always an exceptional event, we shall wait for power exchanges in Europe to analyze the situation in detail and provide the report,” he said. However, given that the threshold was reached around 2 pm-3 pm, it seems that high renewable production, primarily solar, had a great influence, coupled with the lower consumption over the weekend, according to him.

Weekends are specifically “problematic”

Last year, the EU installed 41.4 GW of solar power plants, an increase of 47% year-on-year. This compares to the 42% growth in 2021, when the 28.1 GW of solar capacity was installed.

“A negative price is a market condition when the producer is, for different reasons, not willing to stop producing, even if they have to pay for that. The reasons for that are diverse, maybe it is too expensive to turn off and on the production unit for one hour during the day and it is maybe cheaper to pay for one hour of production,” he said.

Analysts point out that this could happen again on the coming weekends this summer, and Pregl notes that the EU has ambitious targets for the installation of renewable power plants and that the war in Ukraine has even accelerated this process.

Weekends are specifically “problematic,” since consumption drops due to lower economic activities, but also some public holidays, like Easter, when the weather is potentially warmer, triggering lower demand due to lower heating. Combined with strong wind and solar production, this situation is ideal for negative prices, he says.

Sunday is ideal to charge your electric car or battery, boost green hydrogen production, or even fill in pump-storage reservoirs

Basically, the market is not yet ready to utilize the true potential of renewable sources. Exactly, says Pregl, adding that the main problem is the lack of flexible consumption or storage.

A situation like this weekend is ideal for charging your electric car, charging your battery, or increasing the production of green hydrogen, or even filling in the pump storage reservoirs. “The problem is that it seems we do not have enough storage and flexible consumption,” Pregl says.

There are not enough batteries or pump-hydro output that can use electricity in cases of too much production, and negative prices are a clear signal that we need more such capacities, he says.

He also pointed out that there were many countries without negative prices this weekend. In Slovenia, the price was minus EUR 500 per MWh, while in Italy it was plus EUR 93.21 per MWh. This highlights the lack of cross-border transmission lines, and negative prices are a signal to decision makers to do something about it, according to him.

Asked whether the reform of the EU’s electricity market design, which is underway, can solve these problems, Pregl says that it is still unclear what the reform will look like because negotiations between EU members are ongoing.

Stojčevski: Negative prices will eventually be enabled in Western Balkans

“All this was expected, and it will happen again in certain periods during the year and during major holidays, because production exceeds consumption, particularly in daytime and during the hours of low consumption, when there is plenty of sunshine,” says Dejan Stojčevski, Chief Operating Officer of the SEEPEX power exchange.

This demonstrates that the further integration of renewable energy sources requires investment in energy storage, because without it, investments in solar and wind will not be viable, according to him.

Negative prices are not possible on SEEPEX, nor the Serbian power market as a whole. Although market participants have asked for this option to be introduced, that would not be in accordance with the existing regulations. Such a move would require changes to the laws on value added tax (VAT) and energy, and probably to market rules, says Stojčevski.

The lowest price allowed on SEEPEX is zero, according to Stojčevski.

Currently there are no players on Serbia’s power exchange who could find themselves in a situation where they would benefit from negative prices, but that could change once the planned power plants are completed. Of course, they will have other options available to avoid being affected by such prices or paying penalties for delivering energy that nobody will withdraw.

They will be able to prevent this by trading on the intraday market or the bilateral market, or by building storage capacities or joining a larger balancing group, according to Stojčevski.

If negative prices are not introduced on SEEPEX, producers might find themselves unable to sell generated electricity and forced to pay for balancing, which is the most expensive option, according to him.

This applies to all newly-established power exchanges in the region, such as Albania’s ALPEX, Montenegro’s BELEN and the power exchange in North Macedonia, operated by MEMO, as well as markets that do not have the option of a negative price.

This can be resolved by enabling negative prices – the European solution that Serbia and the rest of the region will at some point embrace, according to Stojčevski.

Be the first one to comment on this article.