Photo: Carbon Tracker / ChatGPT, DALL-E

Carbon Tracker concluded in a recent report that cement production technology has no credible alternatives for decarbonization without carbon capture, utilization and storage (CCUS). The approach in other hard-to-abate sectors should be careful, but there is potential, while the iron and steel sector isn’t suitable for such solutions, the analysis revealed.

In the cement industry, the world’s first facility of the kind is yet to be completed, in Norway. Experts agreed at the presentation of the report that a strong carbon price is the single most important measure for scaling CCUS.

In its Curb your Enthusiasm report, Carbon Tracker outlined the trends and segments of the emerging carbon capture, utilization and storage industry, with the United Kingdom as a case study. The country is working on the establishment of a self-sustaining market without subsidies.

“The UK has got a long history with CCUS. The first program started almost 20 years ago. However, to date we still don’t have any project on the ground. Today the UK has got an ambitious target of becoming a global leader. It has set a clear ambition in terms of a target. The initial step will require creating and kickstarting a CCUS market in the 2030s, with a target of achieving at least 50 million tons of carbon captured by 2035,” said Lorenzo Sani, the London-based think tank’s power and utilities analyst who signed the publication.

Heidelberg Materials is due to equip its cement plant in Norway with a CCUS facility this year

The cement industry accounts for 2% of UK emissions and 60% of the amount can’t be removed without CCUS, he pointed out. It means there is no credible alternative, Sani said. One of the major challenges in the sector is that there is still not a single CCUS system operating commercially in the world.

Only Heidelberg Materials is building one, at its cement factory in Norway. The Brevik CCS project, envisaged to capture 50% of the plant’s emissions, is due to be completed this year. Two British projects are at an advanced stage of development.

Of note, the CCS acronym is used for the technology without the utilization part. Carbon dioxide is mostly used for so-called enhanced oil recovery (EOR) at the moment. It consumes 80% of the captured greenhouse gas worldwide, effectively canceling the climate benefit, the organization said.

Iron, steel have no future with CCUS

Unlike cement, iron and steel have no future with CCUS, the analysis revealed. Using hydrogen is a better alternative, especially in Britain and Europe, Sani stressed. It results in higher emission reductions at a similar cost, according to the calculation.

Other uses have potential, but Carbon Tracker recommends a cautious approach. Producing blue hydrogen from natural gas, which implies carbon capture, can kickstart the consumption of hydrogen as a fuel.

Expansion of green hydrogen and demand uncertainty make investments in CCUS for the production of blue hydrogen highly risky

Blue hydrogen is expected to remain cheaper than green hydrogen until at least 2050, the document reads. But there is large uncertainty around demand, as it is projected at two to six million tones for 2035 in the UK. Sani highlighted the risk of market saturation, particularly with growth in green hydrogen volumes.

Biomass power is three time more expensive than solar, wind even without carbon capture

Turning to bioenergy with CCS or BECCS, the report’s author underscored that the UK is exposed to one giant project, for the Drax biomass-fired power plant. It would be the largest in the world, like the power station itself. Even without CCUS, biomass power is at least three times more expensive than wind and solar, Sani warned. He estimated that a 15-year subsidy scheme would cost more than GBP 25 billion.

Since burning biomass is considered carbon neutral under stringent sustainability criteria, sequestering CO2 emissions from its combustion generates negative emissions. But Carbon Tracker recommends scaling up removals starting from smaller-scale projects (such as energy from waste)

As for decarbonizing gas power plants with CCUS, there is high risk of stranded assets if there is overinvestment, Sani said. With the penetration of batteries and flexibility solutions, such facilities would be needed for shorter and shorter periods when there’s no sunshine or wind, he said. Power plants using hydrogen could become cheaper, he suggested.

UK leans on industrial clusters in its national strategy

The UK has a particular advantage of access to depleted offshore oil and gas fields. The government earmarked GBP 20 billion in funding to support the CCUS industry.

Another favorable factor is that 70% of industrial emissions are concentrated in only seven industrial clusters. A single CO2 transportation and storage infrastructure system can serve multiple facilities. There are projects for four clusters.

IEA’s Greenfield: We need to cut building time as we are running out of time

Finally, the UK must fix its carbon market to create a long-term price signal above GBP 100 per ton that can provide the right incentive to the CCUS market, the report reads, stressing it as the most important factor. For the power sector, GBP 120 would be necessary for applications to compete on a merchant basis, the numbers showed. Prices have lately held between GBP 30 and GBP 40 per ton of CO2.

At the presentation of the report, other experts agreed that a stable and sufficiently high carbon price is necessary for a self-sustaining market. They also noted that transportation and storage projects take longer, five to seven years, than building a carbon capture unit, currently three to four years.

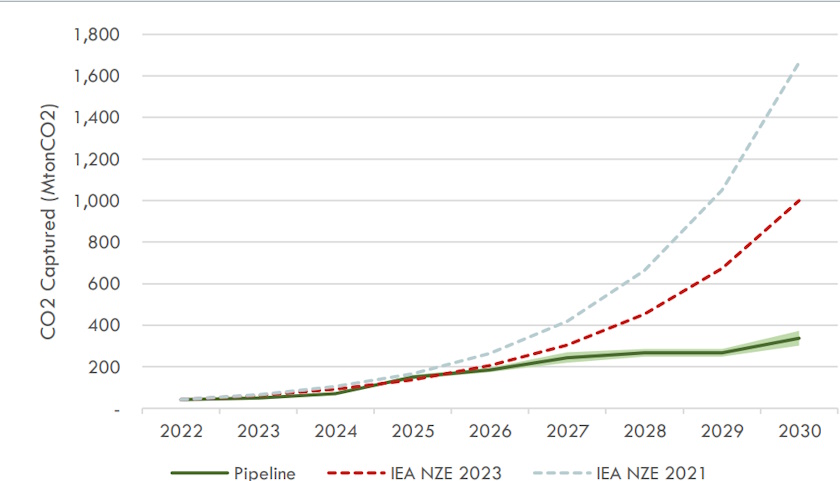

“We need to cut building time as we are running out of time,” said Carl Greenfield, an energy analyst from the International Energy Agency. In the IEA’s current Net Zero Emissions by 2050 Scenario (NZE), CCUS contributes to 8% of total emission reductions, mostly abating the cement and chemical industries, while contributing to a smaller extent to the steel and power sector.

Even when the agency lowered its projections of CCUS capacities, they still outpaced the project pipeline by far.

Overpromising-underdelivering

Carbon Tracker’s review found “a consistent trend of overpromising and underdelivering, worsened by numerous ill-suited business models.” Projects are often delivered late and over budget, while the promised high levels of carbon capture rates are regularly not materialized, it said.

“Most projects require tailored engineering and bespoke infrastructure while being characterised by low modularity and scale. As a result, we found very low levels of technology learning and cost reductions in the whole supply chain,” the organization added.

Direct air capture is most expensive by far

As a general rule, capture costs are higher when CO2 is extracted from flue gases with low concentrations of CO2 and many impurities. They are exactly the applications where CCUS would be needed the most: cement, steel, power and direct air capture (DAC or DACCS).

Examples of low complexity and costs are natural gas processing, where CO2 is extracted to achieve purity, and ethanol production and the chemical industry. The price of capturing carbon dioxide per ton ranges between GBP 15 and GBP 35. Cement is at GBP 55 to GBP 90 per ton, in comparison with GBP 50 to GPB 80 for iron and steel.

Direct air capture or DAC costs a staggering GPB 550 to GBP 800 per ton as there is a very small share of carbon dioxide in the atmosphere.

Precombustion capture accounts for 94% of the current global capacity. Post-combustion capture, which is more complex and expensive, refers to capturing CO2 from flue gases produced by the combustion of fossil fuels or biomass.

Be the first one to comment on this article.