Photo: Pixabay

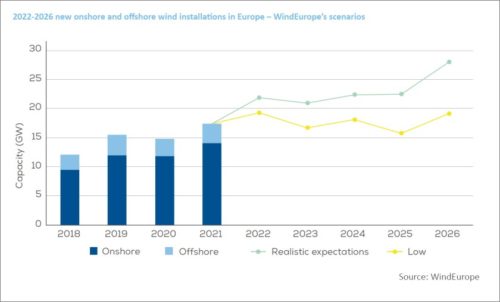

WindEurope’s Annual Statistics 2021 report showed 11 GW of wind farms was added last year in the EU, while 18 GW is expected to be built per year through 2026, compared to 32 GW a year of new wind that is necessary to meet the 2030 renewables target. Turkey achieved the greatest expansion in Europe after the UK, Sweden and Germany.

Europe is not building enough new wind energy to reach its energy and climate targets and the slow tempo is impacting the supply chain in the sector, WindEurope said. The organization warned European Commission President Ursula von der Leyen that the wind energy industry is in “poor health.”

In its Annual Statistics 2021 report, WindEurope highlighted the insufficient speed of expansion. Europe as a whole installed 17.4 GW of new wind power in 2021, bringing its total installed capacity to 236 GW.

EU must double annual wind additions

According to WindEurope’s calculations, the European Union needs 32 GW per year to lift its renewable energy share to 40% by 2030. But it built only 11 GW last year and is set to build only 18 GW a year over the next five years.

“These low volumes undermine the Green Deal. And they’re hurting Europe’s wind energy supply chain,” WindEurope’s Chief Executive Officer Giles Dickson said.

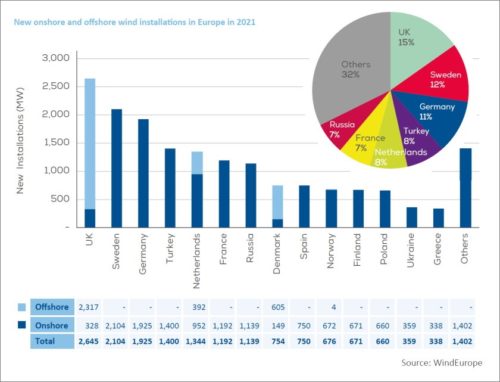

Last year the United Kingdom added the most offshore wind, and the most gigawatts overall. Sweden, Germany, Turkey and the Netherlands are the next four countries with the most new wind in 2021, in that order.

Germany seen surpassing UK in wind expansion

Onshore wind accounted for 81% of new capacity and the share is seen decreasing to three quarters over the next five years, according to the document. Germany is expected to take over the lead in new wind in the period, followed by the UK, France, Spain and Sweden. The organization expects 116 GW of new wind farms by 2026.

“Permitting remains the main bottleneck. Europe is not permitting anything like the volumes of new wind farms needed. And almost none of the member states meets the deadlines for permitting procedures required in the EU Renewable Energy Directive,” WindEurope stressed. It pointed to the jump in prices of steel and other commodities and said four out of five wind turbine manufacturers in Europe were operating at a loss last year.

Permitting remains the main bottleneck

“Steel, 100% recyclable, is at the core of many green technologies, not least wind turbines. To further reduce the environmental impact of these technologies, the European steel industry is moving towards CO2 neutral steel production in Europe, requiring already by 2030 about 150 TWh of renewable, affordable electricity. But the EU is not building enough renewables to fuel the steel industry’s transition,” EUROFER Director General Axel Eggert said.

Out of the 17.4 GW in new wind installations in Europe, 14 GW was onshore. The total figure surpassed the record 17.1 GW, registered in 2017, but it came 11% lower than forecasted. Sweden installed most new onshore wind (2.1 GW). The UK installed most new offshore wind (2.3 GW).

Turkey is seventh in Europe in total wind power capacity

As for Southeastern Europe, Turkey led the way in 2021 with 1.4 GW in new wind onshore. It reached an overall 10.75 GW, which makes it the seventh in Europe in accumulated capacity. Greece is next in new additions in the Balkans – 338 MW. The total climbed to an impressive 4.45 GW.

The share of wind in the two countries’ power demand is 10% and 18%, compared to 15% for all European countries that submitted data. Croatia boosted its wind power capacity by 187 MW, reaching 990 MW. The Bajgora wind farm, also known as Selac, came online in Kosovo*, adding a nominal 105 MW. The total reached 137 MW.

Most Balkan countries didn’t open a single wind power plant in 2021

The data shows no increase in Bosnia and Herzegovina, but the registered 135 MW clearly includes the Podveležje facility, which was finished a year ago. The remaining countries in the area covered by Balkan Green Energy News had little or no additions.

Romania is at 3.03 GW, Bulgaria’s capacity remained at 707 MW and Serbia has 374 MW. Cyprus remained at 158 MW, followed by Montenegro’s 118 MW and North Macedonia’s 37 MW. Slovenia’s total capacity is just 3 MW. There are no wind turbines in Albania.

Be the first one to comment on this article.