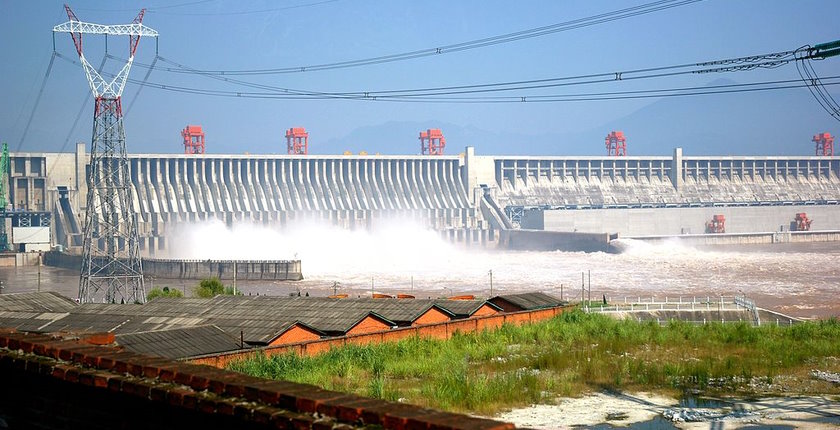

Photo: Allen watkin / https://creativecommons.org/licenses/by-sa/2.0/legalcode

The start of trading showed the long-awaited initial public offering of Romanian hydropower producer Hidroelectrica was a success for investors. The stock surged as much as 10.8% at the Bucharest Stock Exchange today, lifting the utility’s market capitalization to EUR 10.5 billion.

After several failed attempts over the past decade, Romania’s state-owned Hidroelectrica started trading today under the ticker H2O on the premium market segment of the Bucharest Stock Exchange. In the initial public offering, settled at the beginning of the week, minority shareholder Fondul Proprietatea sold most of its 19.94% stake.

The shares were priced at RON 104 (EUR 21) apiece, just above the middle of the indicated range of RON 94 to RON 112 per share, translating to EUR 9.4 billion in market capitalization.

Hidroelectrica was on a firm and steady rise in early trading. It jumped as much as 10.8% to RON 114.4 per share, boosting its valuation to EUR 10.4 billion.

Europe’s largest IPO in 2023

It was the largest IPO so far this year in Europe. The company said it was several times oversubscribed, though it didn’t reveal a precise figure. It allows Fondul Proprietatea to sell the 2.6% stake that it kept, within the next 30 days.

Retail investors in Romania were entitled to a 3% discount from the offer price

The government, which holds 80.06% of the company, is not allowed to sell any shares for at least a year after the listing. The IPO was part of an agreement with the European Commission regarding the adoption of the National Recovery and Resilience Plan (NRRP or PNRR), which Romania required to access European grants and soft loans.

Fondul Proprietatea, managed by Franklin Templeton International Services, sold 80% of the package to institutional investors. Retail investors in Romania were entitled to a 3% discount from the offer price for applications submitted on the first five business days of the offer period.

Hidroelectrica launched several investment projects ahead of IPO to motivate investors

Hidroelectrica owns and operates 182 hydropower plants with a combined capacity of 6.3 GW as well as five pumped storage units. Its sole wind farm, Crucea Nord, has 108 MW. The company’s gross hydropower output came in at just 13.6 TWh last year due to drought. The result compares to 16.9 TWh in 2021 and 15 TWh in 2020.

In the past five years, Hidroelectrica had a share of 29% in Romania in electricity production. According to a news report from early this year, the utility was the most likely candidate for taking over a 1.5 GW solar power project on state land, which would make it the biggest in Europe.

In addition, over the past year, the company agreed with Masdar to invest in renewables through a joint venture, started to plan a hydrogen production facility and revived several dormant hydropower projects.

Of note, thyssenkrupp nucera, a hydrogen joint venture of German industrial giant thyssenkrupp and Italy-based De Nora, ended its first day of trading on July 7. It finished 17.6% in the green, lifting its market capitalization to almost EUR 3 billion.

Be the first one to comment on this article.