Photo: Montel

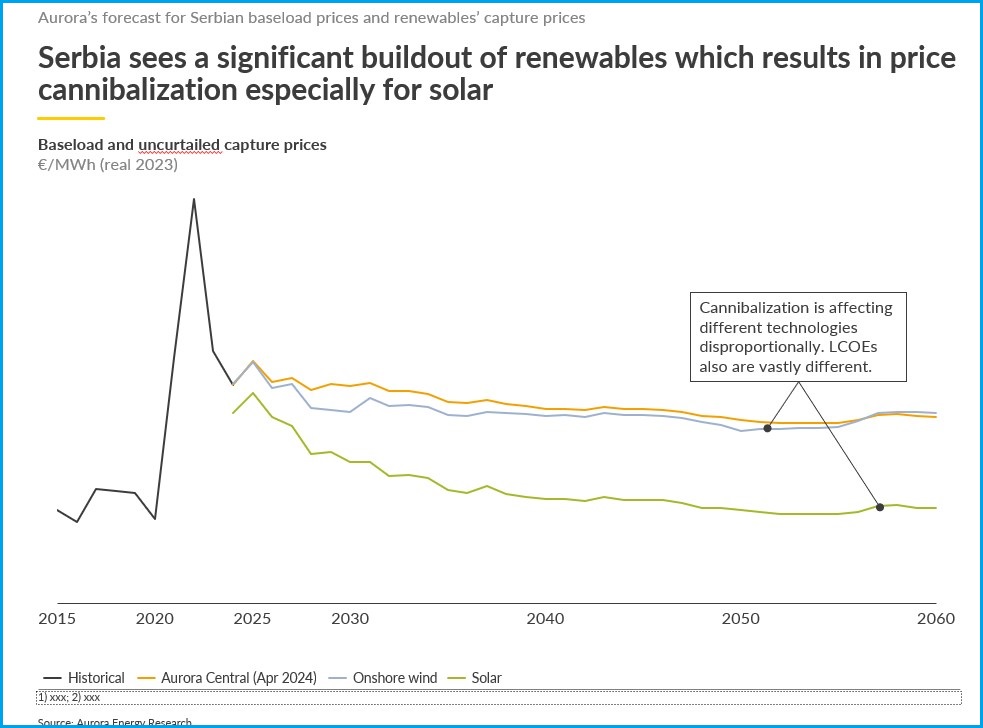

Wholesale baseload electricity prices in Serbia and entire Southeastern Europe are seen decreasing until 2050, with capture prices for solar power significantly lower than for onshore wind power and baseload prices, according to projections calculated by Aurora Energy Research.

The trends for wholesale baseload electricity prices and renewables capture prices are similar for the 2025-2060 period but the absolute levels for wind and solar power are more different, according to senior analyst Júlia Szabó from Aurora Energy Research.

At the SEE Energy Day 2024 conference in Belgrade, organized by Montel, she presented the market landscape in Southeastern Europe according to the firm’s projections.

In the short term, baseload prices are decreasing, as the upward pressure on gas prices is easing, especially after 2025 given the arrival of a liquefied natural gas (LNG) terminal in the region, Szabó said.

In her words, baseload prices are expected to be stable, plateauing around 2050 at EUR 80 per MWh to EUR 85 per MWh.

“This is a projection for Serbia. However, since we expect market coupling and increased interconnectivity, the drivers, trends, and outlook are very similar across the region. Of course, keeping in mind the slight differences. But the graphs for Hungary and Bulgaria would look very similar, not only for baseload prices but also for solar and wind power capture prices,” she stressed.

The projection takes the effect of cannibalization into account as well as specific profiles of each technology and the cross-border effect.

“If we look at solar capture prices, we can see the trend is pretty similar to baseload prices, but the discount compared to baseload is sharply increasing. In the long term, 2040-2060, we expect solar capture prices of Serbia or in most of Southeastern Europe to be 40% to 50% below the baseload price,” she said.

Aurora is forecasting a sharp increase in renewables capacities over the long term

Szabó attributed the phenomenon to the technology profile of solar power, hourly generation patterns and the cannibalization effect.

According to her, the trends are similar for onshore wind power capture prices, but the discount compared to baseload is much smaller, expected at 1% to 4%.

Aurora is forecasting a sharp increase in renewable energy capacities over the covered period, considering it a key driver in pushing prices down and resulting in the effects mentioned above. It applies not only to Serbia but all around the region, Szabó noted.

Be the first one to comment on this article.