Photo: iStock

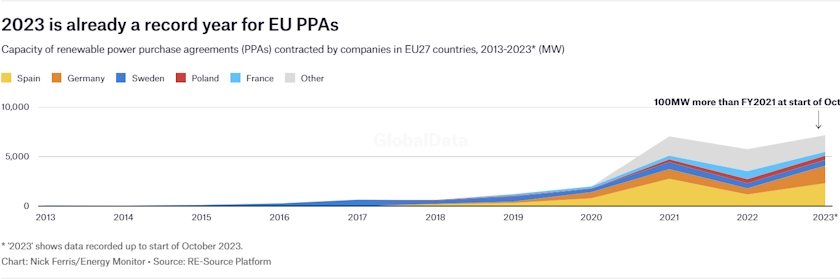

By the end of the third quarter, 2023 was already the record year in the corporate power purchase agreement market in the EU, according to RE-Source Platform. The ICT sector and heavy industry have contracted the most capacity by far. A different report showed overall wind and solar PPA prices grew 2% each from July through September.

Only six European Union member countries – Estonia, Latvia, Luxembourg, Malta, Cyprus and Slovakia – have yet to register their first corporate renewable power purchase agreement or PPA, according to RE-Source Platform’s data. Hungary, Lithuania, Slovenia and Portugal entered the market in 2023, contributing to making it the record year in contracted capacity. Bulgaria, Austria, Croatia and Romania made their debuts last year.

RE-Source Platform registered deals for 7.8 GW in total by last week. With 7.2 GW by the end of September, the measure already surpassed the previous annual all-time high in the EU, achieved in 2021.

Spain is the largest market in 2023 so far, as it also was in the previous three years. It registered its first PPA only in 2018. Spain is also the fourth largest corporate renewable PPA market in the world, after the United States, Brazil and Australia, according to the International Energy Agency.

Energy buyers are calling for market caps to be scrapped

RE-Source Platform said corporate energy buyers are calling for regulatory certainty – an end to market caps. They are asking policymakers reforming the electricity market design in the EU to improve grid access and accelerate permitting for new wind and solar farms.

Support is required to manage price risk and enhance bankability, as well as to “demystify PPAs and educate procurement staff in companies,” the statement adds. SolarPower Europe and WindEurope backed the plea.

ICT and heavy industry dominate the corporate PPA market

The report highlighted similar major obstacles for developers – unreliable grid access, slow permitting and price risks related to the variability of solar and wind power.

In the first three quarters of the year, over 60% of corporate renewable PPA deals were signed by companies in the ICT sector (2 GW), heavy industry (1.8 GW) and telecoms (650 MW). Their respective total capacities grew 22% to 11.3 GW, 25% to 9 GW and 35% to 2.5 GW.

The automotive and retail sectors both surpassed 1 GW in overall contracted capacity this year, joining the segments of transportation and consumer goods.

PPA price offers rally 18.2% year on year

LevelTen’s Energy PPA Price Index advanced 2% to EUR 86.94 per MWh in the third quarter. The gauge tracks wind and solar power. Both components added 2% from July to the end of September, to EUR 99.82 per MWh and EUR 74.06 per MWh, respectively.

The regional index tracks 18 EU countries and the United Kingdom. The company’s P25 methodology covers price offers from owners of renewable energy projects under development for corporate clients and not the prices in transactions. The symbol refers to the most competitive 25th-percentile offer prices, where the majority of PPA deals normally occur.

The most competitive marketplace offers or market clearing prices can be significantly lower than the P25 index.

The latest update was calculated from 186 price offers from 145 projects across 18 countries. On a year-to-year basis, the blended index surged 18.2%. The wind component soared 27.2% against 8% for solar power.

Labor shortage taking its toll on solar power sector

Ongoing interest rate hikes are strengthening cost pressures in both sectors, the report’s authors pointed out. They also highlighted the increasing frequency of negative electricity prices. Price volatility can be attributed to factors such as growing price cannibalization, more distributed generation, legacy subsidy schemes and grid infrastructure that is generally unprepared for renewables, the document adds.

Developers of wind and solar power projects are pressured by growing interest rates and negative electricity prices

“A stabilizing supply chain has alleviated some upward price pressure in the first half of 2023, but a significant drop in French nuclear generation in recent months has pushed up electricity prices across Central Europe, raising solar PPA prices in markets like France, Germany, and Poland. Perhaps most impactfully, a looming labor shortage is also stressing project finance models and has begun placing a premium on EPC [engineering, procurement and construction] costs for solar developers,” the company said.

On the wind front, data indicates that the industry seems to be resurging. However, significant permitting headwinds and community opposition in many markets are adding costs and extending development timelines, the report reads. What’s more, as the economics of wind development continue to recover, a double-edged sword of stubborn inflation across project inputs and rate hikes continue to add expenses, LevelTen warned.

Be the first one to comment on this article.