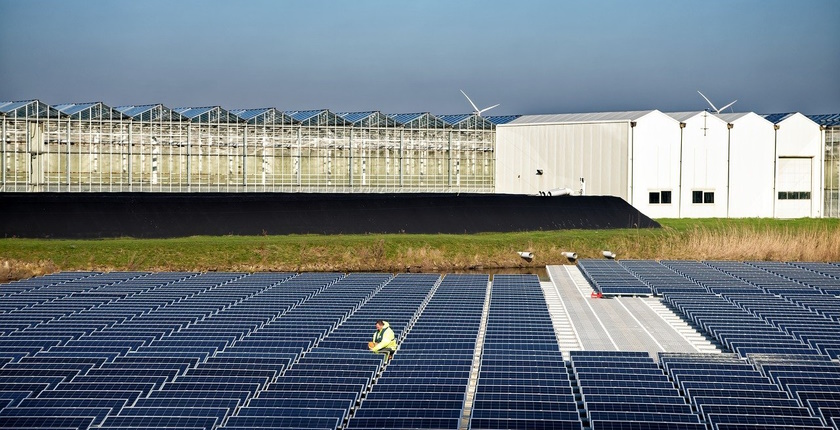

Photo: Alfred Grupstra from Pixabay

The Green for Growth Fund (GGF), advised by Finance in Motion, has invested EUR 20 million in NLB bank’s inaugural green bonds of EUR 500 million. The fund said it aims to provide support specifically for various projects in the field of renewable energy in Bosnia and Herzegovina, Kosovo*, Montenegro, North Macedonia, and Serbia.

Slovenian NLB Group will strive to allocate the bond issue amount to support eligible green projects complying with the conditions defined in NLB’s Green Bond Framework (Framework), the GGF said.

In a second-party opinion, Sustainalytics assessed the framework and expressed confidence that it is robust, transparent, and in alignment with the four core components of the Green Bond Principles 2021.

GGF has been working in partnership with the NLB Group since 2011

According to the GGF, the investment is expected to contribute to SDG 7 (affordable and clean energy) and SDG 13 (climate action) by financing green energy transition projects and initiatives across Southeast Europe, a region still heavily reliant on coal to meet its energy needs.

Such diversification will also contribute to energy independence and take a step toward achieving the region’s goals made under the Paris Agreement.

GGF has been working in partnership with the NLB Group since 2011, when the fund first extended a facility to NLB Banka, Banja Luka, (formerly named NLB Razvojna Banka), to support low-carbon heating and distributed renewable energy production.

Knowles: We believe this green bond will create new opportunities for financing green projects that will have a positive impact on both the environment and society

“We are very pleased to invest in this important green bond issuance which marks another step in our long-term partnership with NLB. With this investment, we look forward to reinforcing our shared commitment to and supporting the transition to a low-carbon economy in North Macedonia, Montenegro, Serbia, Bosnia and Herzegovina, and Kosovo. We believe this green bond will create new opportunities for financing green projects that will have a positive impact on both the environment and society,” GGF Chairman Christopher Knowles said.

According to NLB’s CEO Blaž Brodnjak, the transaction reflects strong credit and performance of the NLB Group and demonstrates that NLB has wide access to capital markets, and very importantly it is a measure of confirming our approach to sustainability.

“In the NLB Group we firmly support the transition to a low-carbon sustainable economy that will use resources more efficiently,” Brodnjak added.

Be the first one to comment on this article.