Photo: David Vives on Unsplash

The Western Balkans need to step up the integration of their power markets and introduce carbon pricing systems to avoid paying the CO2 border tax prepared by the EU, which should assist the countries of the region in the necessary reforms, Agora Energiewende said in a report. The analysis shows new coal-fired power plants would bring heavy losses.

The timeline to prepare for the introduction of the European Union’s CO2 border tax is tight. In its new paper The EU’s Carbon Border Adjustment Mechanism: Challenges and Opportunities for the Western Balkan Countries, German climate think tank Agora Energiewende argues the countries of the region need a larger share of available EU funds for a just transition and socio-economic convergence with the 27-member bloc.

The carbon border mechanism, CBAM, is scheduled to be rolled out gradually from 2026 for imports with high CO2 intensity: iron and steel, cement and clinker, fertilizer, aluminum and electricity.

Way out of CO2 border levy for electricity but also other products

The Western Balkans and the rest of the Energy Community have the opportunity to delay the introduction of the levy for power exports to the EU until 2030, Agora noted in the report, produced in cooperation with enervis. It implies integrating with the EU’s electricity market through coupling, and aligning with the relevant goals and legislation such as the commitment to achieve climate neutrality by 2050 and incentives for renewables.

The countries in the region have less than a decade to enter the EU Emissions Trading System (EU ETS), or to implement their own carbon pricing schemes. A completely compatible system would enable them to avoid CBAM altogether and keep the revenue. Otherwise, the funds will be directed to the EU’s budget and its member states’ climate action.

CBAM is primarily intended to prevent carbon leakage – the case for the EU’s industrial producers to move to countries with looser climate rules

Similarly, revenue from carbon pricing in the Western Balkans would be earmarked for greening the economy, especially through the development of renewable energy projects. It is important to say that the CBAM is primarily intended to prevent the EU’s industry to move to countries with looser climate rules. Such a process is known as carbon leakage.

In order to avoid the carbon border tax burden, third countries must also prevent the indirect import of electricity into the EU from countries that don’t meet the requirements. In its recommendations, Agora said the EU should commit to using CBAM revenues for technical assistance and transfer of knowledge to countries developing carbon pricing.

No sense to keep coal plants running past 2040

The EU is the main trading partner of the Western Balkan countries. Agora warned the CO2 border tax would shrink exports of goods with high carbon intensity, impacting the region far beyond the power sector. The CBAM will even reduce opportunities to export carbon-free power to the EU to some extent, the authors found.

Plans for new lignite power plants in the Western Balkans should be halted, according to the paper. An earlier study showed CBAM would slash exports by half in 2040 if the countries keep their lignite fleet and add new units.

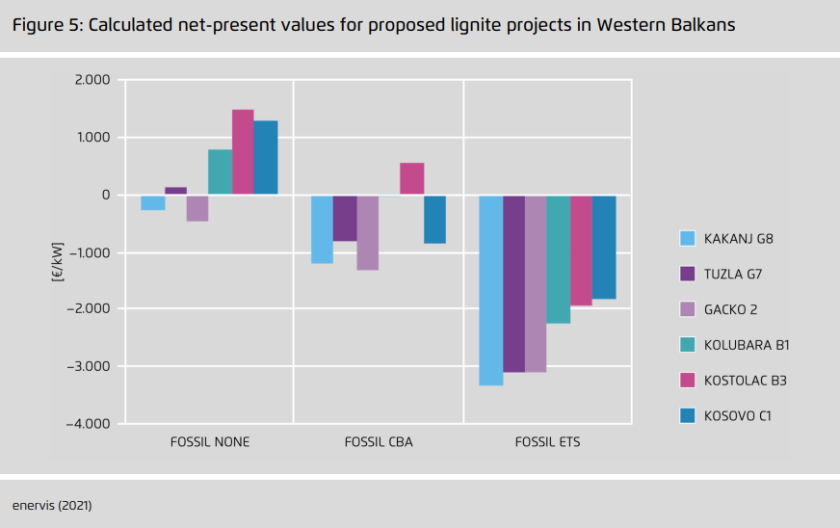

The CBAM will even reduce opportunities to export carbon-free power to the EU to some extent

The analysis was performed for coal-fired plant projects Kakanj G8, Tuzla G7 and Gacko 2 in Bosnia and Herzegovina, Kosova C1 in Kosovo*, and Kolubara B1 and Kostolac B3 in Serbia. Two of them (both in BiH) would be making a loss if built today even without any carbon pricing. The CBAM would leave only Kostolac B3 above water, and in an ETS regime all units are deeply in the red, the calculation revealed.

Furthermore, with the introduction of a carbon price either at the EU border or in the region itself, existing lignite units should be closed by 2040 because it will be economically unsound to keep them running, the document adds.

Barrier for coal-fired electricity

For example, BiH exported 23% of its power output in 2020, earning EUR 117 million. With a CO2 emission charge of just EUR 50 per ton, the expenses would land at EUR 566.5 million for the same amount of energy. A ton of carbon dioxide equivalent currently trades at more than EUR 80 within the EU ETS.

If BiH would have its own internal carbon pricing, it would be able to recycle the funds back into the economy and use them for its decarbonization. With CBAM, that opportunity is not present.

As with its larger trading partners, the EU should engage in good faith with its neighbors on the strengths and weaknesses of the instruments such as CBAM, Agora Energiewende concludes. It should take into account the necessity of economic convergence and the Western Balkans’ reliance on EU assistance, the think tank added and said the countries of the region should use a larger share of available EU funds for supporting a just transition and socio-economic convergence with the EU.

Be the first one to comment on this article.