Photo: Armin Schreijäg from Pixabay

Authors: Pavel Sheytanov, Corporate Sales Trader; Stefan Feuchtinger, Head of Research; Vertis Environmental Finance

A separate emissions trading system is set to emerge in the European Union for fuel for road transport and for buildings and small industrial units. Experts from Vertis Environmental Finance laid out the implications and pointed out that EU ETS 2 would be launched without any free allocations. Moreover, the upper limit of the number of certificates in circulation is expected to be lower than emissions.

In the imminent evolution of the European Union’s Emissions Trading System (EU ETS), a sweeping expansion is on the horizon, encompassing critical sectors such as road transport, buildings, and industrial facilities below the current 20 MW threshold. This significant extension, slated to commence in 2027, with a potential deferment to 2028 in the event of notably high energy prices, marks a pivotal moment of expansion of emissions trading in Europe.

One distinctive feature of ETS 2 compared to ETS is the abandonment of free allocation, ushering in a new era where emission allowances will be exclusively distributed through auctioning. The exact number of entities to be covered remains uncertain, with the EU Commission’s initial impact assessment suggesting the involvement of approximately 11,400 companies.

The trading landscape is therefore set to undergo a comprehensive transformation, embracing the full spectrum of primary market transactions, secondary market trading, and derivative market activities. As this expansion unfolds, the nomenclature of the emission allowances, potentially termed EUA2, remains in a state of flux, awaiting finalization.

The supply side

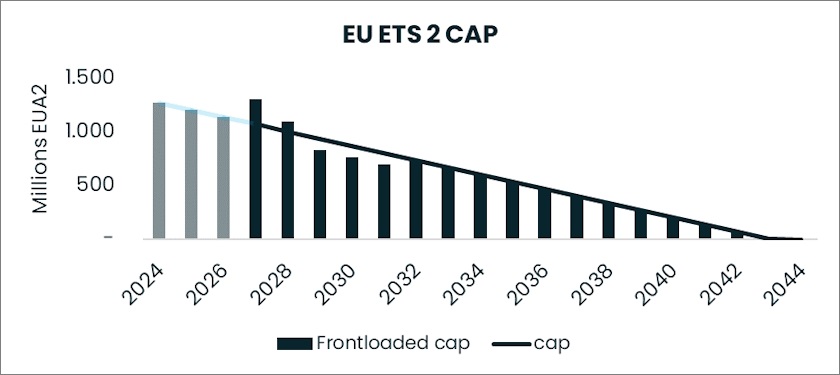

The supply will enter the market in 2027 with no free allocations, going directly to auction. The interaction between reported emissions and allowances is crucial. In 2027, the cap is determined by applying a 5.10% linear reduction factor on the 2024 emission level. The relevant emissions for that period are determined by the Intergovernmental Panel on Climate Change (IPCC) rather than the EU due to an initial lack of measuring, reporting and verification (MRV) data.

Since the system starts in 2027, this sets the cap for only that year, as another calculation will be used for 2028+. The linear reduction factor (LRF) increases to 5.38% and applies as if in effect since 2025. The reference value for applying the percentage are MRV emissions of 2024, 2025, and 2026.

Most of ETS started out heavily oversupplied. EU ETS 2, however, will likely be one of the shortest, if not the shortest ETS ever upon launch as it does not start with a cap that is bigger than the emissions. On top of that, it retroactively applies the LRF already from 2024 (emissions) even though the system only starts in 2027.

The supply will enter the market in 2027 with no free allocations, going directly to auction

Being fundamentally short from the start however would create a serious price threat, which is why the legislator decided to frontload some allowances to give operators more time to adjust to the new system. Hence, the 2027 cap starts out at 130% which get frontloaded for the first 17 months until May 2028, leading to an initial excess of allowances. The frontloading is for the 2029-2031 volumes however, meaning that the excess is quite short-lived.

Based on our emissions forecast, the total supply in 2027 would thus be around 1.3bn allowances, followed by around 1.1bn in 2028 and 830m in 2029. This extremely steep drop in supply will unlikely be matched by an equally steep drop in demand, which is why we expect this market to turn short pretty quickly – the question of how quickly depends on the emissions that can be expected.

The demand side

The demand side has a crucial role in determining the supply-demand balance and hence the potential price.

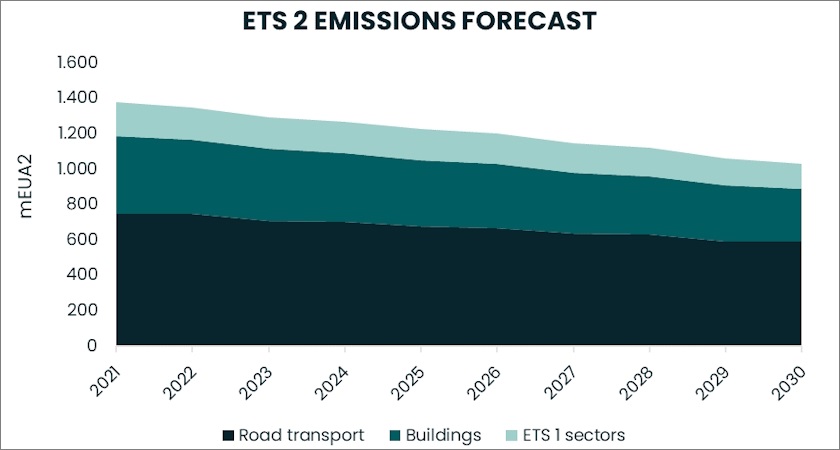

On the demand side of EU ETS 2, we see the to-be-covered emissions being grouped into three broad categories: road transport, buildings, and industrial activities excluded from compliance obligations under EU ETS 1 (due to the 20 MW threshold not being reached). Emission obligations associated with combustion in road transport and in buildings are complied with by suppliers distributing the fuel to the end consumer. This is different from the ETS 1, which covers the burning of fuels and hence is based on the moment the emissions are created.

Based on EEA data, we estimate 2022 road transport emissions at around 737 million tCO2 for EU-27, Iceland, Norway and Lichtenstein. Forecasting this sector is particularly challenging due to major disruptions happening in the EV industry as we speak, while behavioural, regulatory and fundamental factors have a major impact at the same time.

The EU, Iceland, Norway and Lichtenstein had an estimated 737 million tons of CO2 of road transport emissions last year

To forecast emissions in this sector, we have factored in our expected car fleet growth of light, medium, and heavy-duty vehicles in the EU. In each respective category of vehicles, we have modelled for the population distribution of internal combustion engines (ICE), hybrid and zero emissions vehicles (ZEVs) accounting for a growing demand for electric vehicles (EVs), and to a lesser extent hydrogen fuel cell vehicles. Finally, we factor in expected changes in population growth.

As a result, our model forecasts emissions in road transport to amount to around 590 million tCO2 by 2030, a drop of around 21%. We would expect this to be a rather conservative estimation.

Emissions from the buildings sector are expected to have reached about 421 million tCO2 in 2022, and we see these levels reduced gradually by almost 29% in total by 2030 to around 301 million tCO2. This is based on the EU Energy Performance of Buildings Directive, which targets a union-wide climate-neutral building stock by 2050.

The industrial entities that are expected to be covered under EU ETS 2 had an emissions share of approximately 182 million tCO2 in 2022. We expect emissions levels under this category to behave much in the same way as those already covered under EU ETS 1, and hit 141 million tCO2 in 2030, a drop of around 23% from 2022. In our industrial emissions forecast, we account for expected future product demand as well as abatement options such as electrification of industrial processes, and an increased use of biomass.

In total, we see the emissions share from entities being covered under EU ETS 2 to amount to approximately 1.339 billion tCO2 in 2022, and hit 1.03 billion tCO2 in 2030, reflecting a drop of 24% over the period.

The supply-demand balance

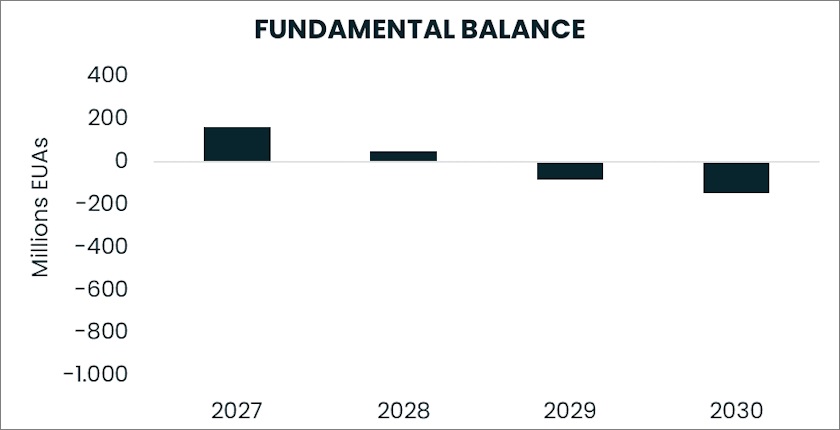

Due to the 130% frontloading of the 2027 cap, we expect there to be around 150m oversupply in the system initially. However, any total number of allowances in circulation (TNAC) below 210m leads to a release of 100m from the MSR. Several price triggers can lead to a release of additional volume of 20m, 50m and 150m.

ETS 2 is expected to turn from a fundamentally long to a fundamentally short market as soon as the frontloading stops

We assume that the first of the two triggers is likely to be activated before 2030, while the last one could be triggered around 2030-2032. That last trigger would mean that prices would have to triple compared to the reference period of the past six months, which is a high threshold. Yet, due to the expected shortness of the system, we would expect that release into the market in the early 2030s at least.

Overall, we see the market turning from a fundamentally long to a fundamentally short one as soon as the frontloading stops, eating very quickly into the oversupply initially generated through the frontloading exercise. This would leave little room for companies that haven’t hedged themselves in the system from the start to do so later on.

While the entire market’s behaviour is hard to predict, we could imagine that the market initially has problems coming really off the ground, until enough liquidity is created, at which point financial actors would likely enter the game, leading to a squeeze in prices worse than the one seen in the ETS 1 from 2019-2021.

The sizes of both ETSs are comparable, but while the ETS 1 will likely still have a TNAC of several hundred million, the ETS 2 would, under our assumptions, run almost completely dry by 2030 – which would inevitably lead to a strong squeeze in prices. In summary, after this initial assessment, we would expect ETS 2 prices initially below ETS 1 prices, before quickly seeing a higher price compared to its older brother before the end of the decade.

Hi,

Great article. Might you share the official sources utilized in creating this article?

Thanks a lot!