Photo: Hans-Jürgen Münzer from Pixabay

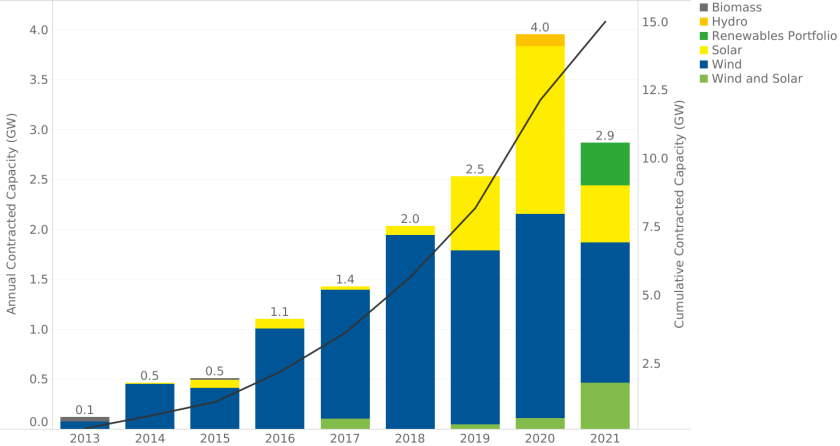

So far in 2021, producers and consumers of green energy in Europe signed corporate power purchase agreements (PPAs) for 2.9 GW, compared to 4 GW for the entire last year, according to the data from the European platform for corporate renewable energy sourcing RE-Source.

Corporate power purchase agreements were signed by first-time purchasers including Danish company Danfoss and Italian telecommunications company TIM as well as repeat customers like Amazon and Danone.

Manufacturer of energy-efficient solutions Danfoss has signed a 10-year fixed-price corporate PPAs with Ørsted to offtake the renewable electricity output of 27 MW of Ørsted’s 209 MW Horns Rev 2 wind farm, while TIM will purchase 3.4 TWh from renewable company ERG over the next 10 years.

Amazon is continuing towards its goal to power 100% of its operations with renewable energy by buying power from a 760 MW wind project in the Netherlands. The Danone-Iberdrola deal will bring online the largest solar power plant in Europe with an installed capacity of 590 MW.

“We were extremely pleased when we looked into the data we collect on corporate renewable power purchase agreements (PPAs) and realised that, although we are only in the fifth month of the year, we have already surpassed the volume of PPAs signed during the whole of 2019 across Europe,” the European platform for corporate renewable energy sourcing RE-Source said.

Last year was record breaking for PPAs in Europe and RE-Source expects 2021 would follow suit.

Corporate PPAs to remain an important route to market for developers

According to ICIS, as many European markets move away from subsidising renewable buildout in coming years, corporate PPAs can be expected to remain an important route to market for developers.

Meanwhile, rising renewable capacity targets in Europe are set to ensure a steady stream of projects coming online, while increased public scrutiny towards corporations’ sustainability strategies could promote growing demand for corporate PPAs, it said.

An expected increase in wholesale power prices in most European countries in the second half of the decade, coupled with falling costs of renewable projects, is also set to promote corporate PPAs as a long-term price-hedging mechanism.

Be the first one to comment on this article.