Photo: iStock

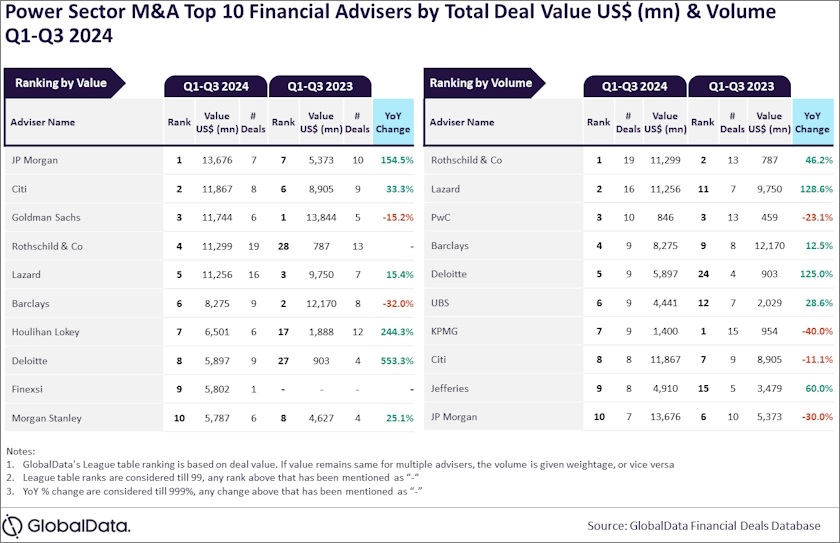

JP Morgan was the world’s top M&A financial adviser in the power sector by total value this year through September, GlobalData said. In the top ten update, Rothschild & Co came in first in terms of the number of deals. In the legal advisers section, Latham & Watkins had the best results in both categories.

Data and analytics firm GlobalData published its financial and legal adviser league tables for the first three quarters of 2024. It ranked the firms by total value and volume of mergers and acquisitions (M&A) deals they advised on in the power sector. The database includes venture capital and private equity sectors.

JP Morgan and Rothschild & Co were the top M&A financial advisers this year in the power sector by value and volume, respectively, in the period until the end of the third quarter.

JP Morgan is first in value, tenth in number of deals

An analysis of GlobalData’s deals database reveals that JP Morgan achieved the top position in terms of value by advising on USD 13.7 billion worth of deals. Rothschild & Co led in terms of volume by advising on a total of 19 deals.

“While JP Morgan went ahead from occupying the seventh position by value during Q1-Q3 2023 to top the chart by this metric during Q1-Q3 2024, Rothschild & Co’s ranking by value improved from second to the top position during the same period. Apart from leading by volume, Rothschild & Co also occupied the fourth position by value during Q1-Q3 2024. Meanwhile, JP Morgan, apart from leading value, also occupied the 10th position by volume,” said GlobalData’s Lead Analyst Aurojyoti Bose.

Citi, Barklays and JP Morgan all remained in the top ten financial advisors

Interestingly, Rothschild & Co was only 28th in the value board in the same period of last year.

Citi occupied the second position in terms of value, by advising on USD 11.9 billion worth of deals. Next are Goldman Sachs with USD 11.7 billion, Rothschild & Co with USD 11.3 billion and Lazard, with USD 11.3 billion.

Lazard came in second in terms of volume, with 16 deals, followed by PwC with 10 deals, Barclays with nine and Deloitte with nine deals.

Citi, Barklays and JP Morgan all remained in the top ten in both lists.

Latham & Watkins was by far most successful in terms of value among legal M&A advisers

Latham & Watkins was the top M&A legal adviser in the power sector by both value and volume. It advised on 23 deals totaling USD 19.6 billion. Both of its scores were more than two times higher than in the first nine months of the previous year. Then it was third in value and ninth in the number of deals.

The top company was by far the most successful in terms of value since the beginning of 2024, as it advised on seven deals worth at least USD 1 billion each, Bose revealed.

Skadden, Arps, Slate, Meagher & Flom occupied the second position in terms of value, by advising on USD 12.2 billion worth of deals, followed by Vinson & Elkins with USD 2.1 billion, Kirkland & Ellis with USD 11.1 billion and Clifford Chance with USD 9.2 billion.

As for volume, Kirkland & Ellis was second with 22 deals, followed by CMS with 21, Vinson & Elkins with 17 and White & Case with 17 deals.

Kirkland & Ellis climbed six notches in the value top 10. Last year it had the highest number of deals in the first three quarters. CMS improved its position as last year it was fourth in the volume chart, with 20 deals.

Be the first one to comment on this article.