Photo: iStock

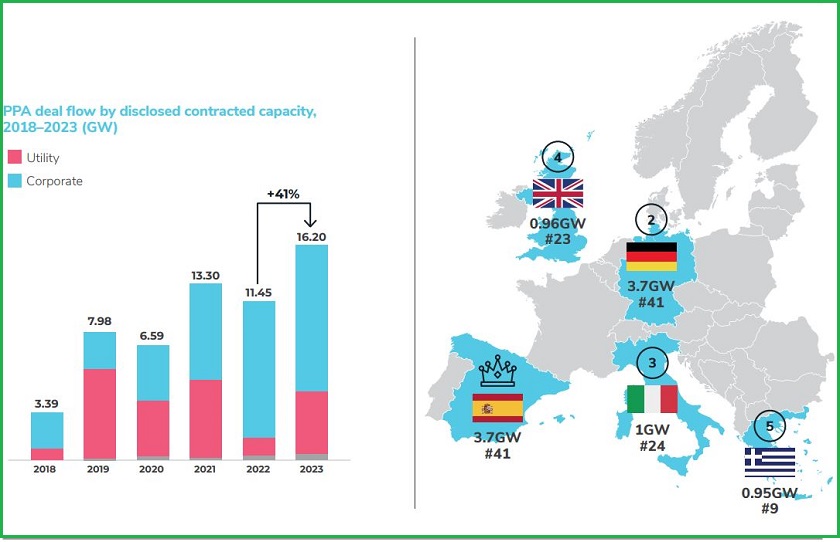

The market for power purchase agreements (PPAs) reached a record 16.2 GW in disclosed contracted volumes last year – an increase of more than 40%. The count hit an all-time high of 272 deals or 65% above the 2022 level.

With a stabilizing environment in the fundamentals of dealmaking, renewable energy players have entered 2023 with a refreshed mindset and a relatively increased sense of stability, significantly increasing confidence in long-term PPAs, Pexapark said in its European PPA Market Outlook 2024, and added that Europe’s PPA universe entered its golden era last year.

According to the provider of advisory services for clean energy PPAs, the turnaround was catalyzed by hard lessons from the year before, an unstoppable corporate army athirst for green energy, and the non-negotiable mandate to push through a smart energy transition.

Pexapark stressed the importance of the deal count, arguing that it illustrates a time when sellers and buyers sat at the table whether the offtake needs were 20 GWh or 1,500 GWh per annum.

Corporate PPAs have maintained the lead

The fact that offtakers transacted 65% more times than the year before truly illustrates the appetite not just from large offtakers that could potentially distort the big image with individual large offtakes, but also from small and medium corporates and industrials that want to be part of the revolution in energy procurement, the report reads.

According to the authors, corporates maintained the lead in driving the PPA market, but there was an uptick in utility offtake activity. Out of the 216 corporate PPAs that disclosed the seller, 44% were contracted with a utility, with the remaining 56% having a developer or independent power producer or fund manager as the counterparty.

Pexapark expressed the belief that the data demonstrate the preference of corporates to contract directly with projects to illustrate additionality more clearly, especially when taking into consideration that many utilities contract with corporates on the back of their own generation.

Spain, Iberdrola, IT

Spain and Germany accounted for PPAs with a capacity of 8.4 GW, or 51% of the total. The former kept its top position for a fifth consecutive year, the report reads.

The country is at the top of the chart both in volume and deal count.

Bilbao-based Iberdrola is the top seller by volume. The company signed nine deals with corporates, amounting to 908 MW. Statkraft was the most active seller, with 19 deals.

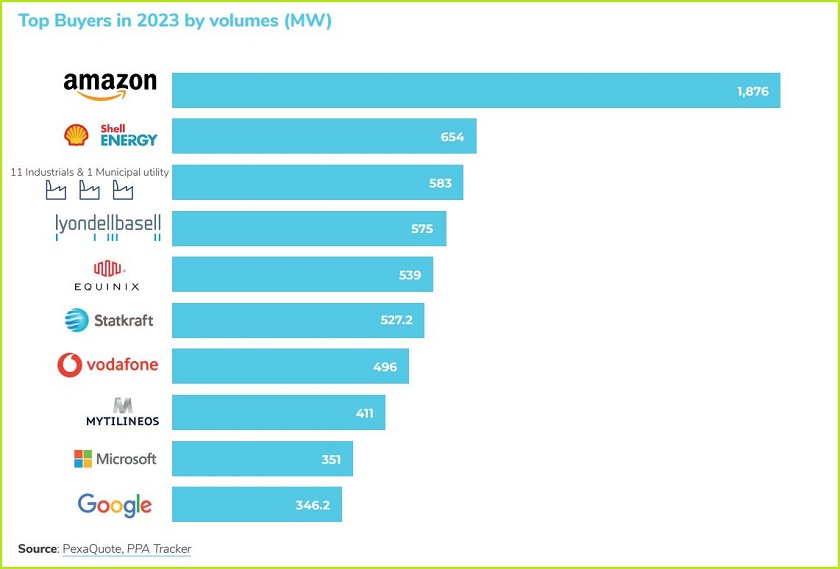

According to the report, Amazon reactivated in the European continent in 2023. The IT conglomerate contracted a bulky 1.87 GW across seven deals. The company also tops the list by deal count.

It was again the sector with the highest result: a total of 3.6 GW across 25 deals, the report reads.

Solar PPA volume comes in five times higher than wind

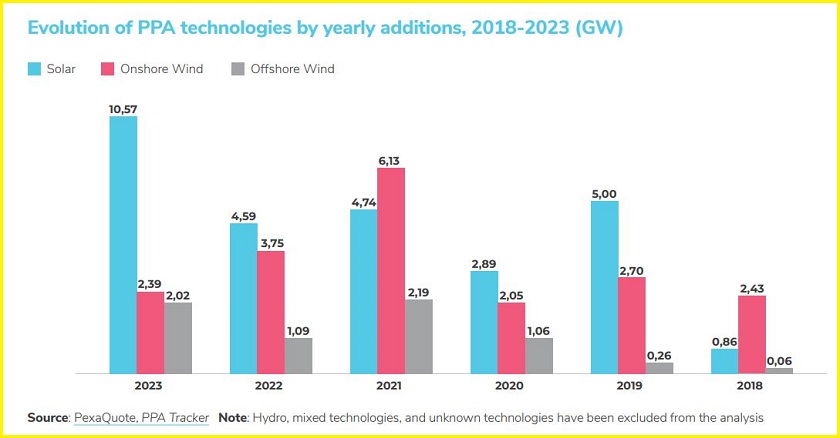

Solar power was by far the most popular in PPA deal-making, holding the lion’s share with 160 deals and 10.5 GW, almost 65% of the total volume, Pexapark said.

Photovoltaics landed roughly five times higher than the onshore wind segment, which accounted for 2.3 GW across 58 deals, and offshore wind, with 2 GW across 20 deals.

Hybrid PPAs have entered the scene

According to the report, the momentum around renewables-plus-storage increased significantly over 2023, as most players are looking at either introducing storage in their portfolio or increasing capacity.

The impetus also manifested in the European PPA market through the emergence of the first hybrid PPAs for large-scale subsidy-free solar assets, the authors said.

Another important trend in 2023 was the rapid growth of PPAs destined to power upcoming green hydrogen and ammonia plants. These types of agreements were announced in Norway, France and Germany.

For 2024, Pexapark said it predicts that Germany would topple Spain in PPA activity. The PPA market will surpass 20 GW, the geographical scope of hybrid PPAs will expand beyond Great Britain, and the share of utility PPAs will increase, it forecasted.

Be the first one to comment on this article.