Photo: EIB

The European Investment Bank (EIB), one of the largest financiers of global energy infrastructure, has launched a new public consultation on financial and advisory support for the sector, to strengthen the impact of its future energy lending, according to a press release from the EU lender.

Over the next three months, the EIB will engage with a wide range of stakeholders, including shareholders, industry associations, civil society, and the private sector to develop a new energy lending policy that supports EU 2030 energy policy and climate targets.

Dialogue with stakeholders will reflect on recent EIB support for energy investment and consider key trends and investment challenges currently facing the sector.

The consultation will include examining how future EIB backed investment can reduce energy consumption through energy efficiency, better support renewable power generation, improve financial and advisory backing for energy innovation, and secure infrastructure essential for energy transition.

The discussion will also include specific considerations on supporting energy investment in developing and emerging economies outside Europe.

The EIB will host a public consultation meeting in Brussels in February (the planned date is February 25), followed by consideration of the new Energy Lending Policy by the EIB’s EU member state shareholders later in the year.

Stakeholders are invited to send written contributions before March 29, 2019, preferably via the email address: elpconsultation@eib.org.

Building on 2013 energy lending review

The new policy will replace the EIB’s Energy Lending Criteria adopted six years ago in the context of Europe’s 2020 targets that ensured strengthened support for clean energy finance including renewable energy, energy efficiency, and related electricity grids.

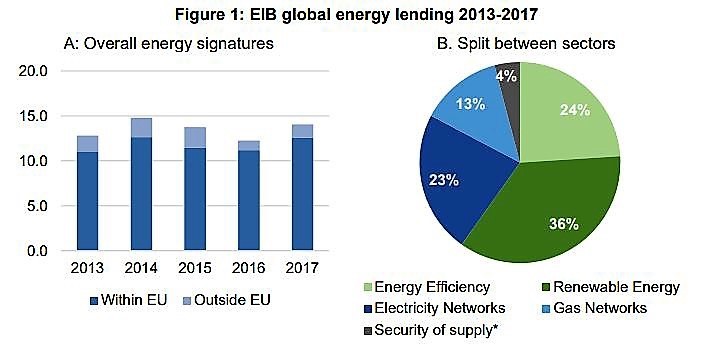

The 2013 Energy Lending Criteria ensured that the EIB transitioned to a very large extent to clean energy finance. Over the five-year period 2013 to 2017, lending was channeled predominantly to renewable energy (36%), energy efficiency (24%), and electricity grids (23%), according to the Public consultation on the EIB Energy Lending Policy document.

The 2013 review introduced a new Emissions Performance Standard. This has since been applied to all fossil fuel power generation projects to screen out investment where carbon emissions exceed a threshold level reflecting EU and national commitments to limit carbon emissions, according to the press release.

Review to build on new European Union energy policy

The public consultation on EIB support for energy investment follows the finalization of the new EU legislative framework – Clean Energy for All Europeans. The revised EU policy represents a significant step towards the creation of the Energy Union and delivering on the EU’s Paris Agreement commitments and is designed to ensure that the European internal energy market delivers investment needed for clean, affordable and secure energy over the next decades, according to the press release.

The new EU energy policy packages seeks to facilitate the energy transition and fixes two new targets for the EU for 2030: a binding renewable energy target of at least 32% and an energy efficiency target of at least 32.5%.

These ambitious targets are expected to stimulate Europe’s industrial competitiveness, boost growth and jobs, reduce energy bills, help tackle energy poverty and improve air quality.

The European Investment Bank is one of the world’s largest energy lenders. In the last five years the EIB has provided more than EUR 49 billion for energy investment across Europe and around the world, including financing for 30 European Projects of Common Interest.

Be the first one to comment on this article.