The future of support mechanisms for renewables with targeted insight towards the SEE markets and bankability point of view

By Ladislav Tolmaci, Erste Group Bank AG, Leveraged and Project Finance

In the recent depressed wholesale power price environment predominant on the European commodity exchanges, any investment into electricity generating technology becomes related to a question of subsidies, incentive schemes (i.e. feed in tariffs), capacity payments, power purchase agreements and other instruments.

The simple reasoning is that on a commercial basis, without these support tools any investment into power generating technologies is not economically feasible for a private investor. However, the feasibility of power investments on a purely commercial basis has rarely been the fact in the past for any new investment that was rather pooled in the power utilities fleets of generating assets. This notion of commercial feasibility is even more evident for the renewable technologies due to their intermittent nature that very much limits their desirability under bilateral arrangements which were considered to be the future for the new build in this area. In the end, despite the good standing of renewable technologies from the perspective of the levelized cost of electricity (i.e. Fraunhofer Institute 2013 puts on-shore wind to 45-107 EUR/MWh) and high end consumer prices (i.e. Eurostat end consumer price households/industry 2015 EU-28: 211/125 EUR/MWh ) – from the general point of view the market price is the pertaining argument when assessing investment into new capacities(i.e. Cal-17 Phelix Fut. on EEX stands at 33 EUR/MWh as of Nov. 2016).

If the market price is not an option to build a business case on, support mechanisms have also provided for negative developments in some aspects as oversubsidizing and creating investment booms with negatively perceived and ill communicated impacts on consumer end prices; therefore the targeted outcome must come as a combination of support measures and market solutions to optimize the price impact on end consumers. The related question price desirability and consumer price impact is even more pressing in the countries with lower GDP/capita as it is the case for with Western Balkan countries.

Currently as a result of the Environmental and Energy State Aid Guidelines (“EEAG” applicable from 1 July 2014, transition period until 2017),a good way forward is being implemented across Europe that puts as its main target market proximity of support mechanisms and gradual move to market based support for renewable energy. Here the new guidelines foresee competitive bidding process being implemented across the renewables landscape.

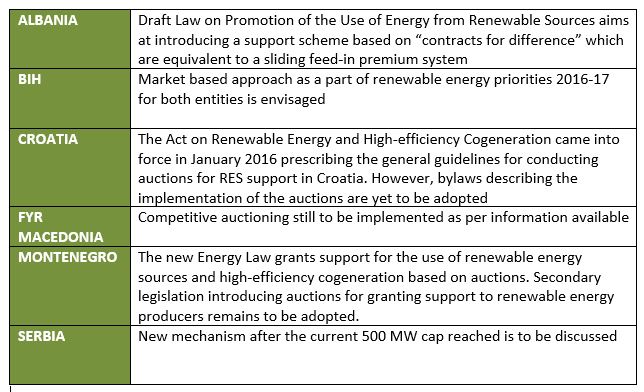

A certain progress has already been made as the bidding processes in forms of auctions for renewable capacities have emerged in some EU countries and many will follow the court (also outside of the current EU framework). Here are some examples from SEE:

Table 1: Prospects for auctioning in SEE countries according to current legislation

Bidding for renewable capacity is beneficial in number of ways. It enables the policy makers to drive the amount of the new installations to be connected to the grid (i.e. the desired MW capacity or overall support budget) to prevent unwanted investment booms, the competition between the investors should create a real price of feasibility of the individual projects and in this way the desired reduction of the subsidy levels would be achieved.

How to set the structure up

Contractually to achieve market proximity, the best tools to implement the results of the auctions in practice are proving to be Contract for Difference (CfD) schemes. In this structure, the renewables generator is awarded as a result of the bidding process a strike price for power being generated. There are two contracts being concluded as a CfD, what is a private law contract between an electricity generator and an off-taker. The generator party to a CfD is paid the difference between the ‘strike price’ – a price for electricity and the ‘reference price’ (i.e. market price). The second contract is a Power Purchase Agreement (PPA) under which the reference price cash flows are secured. The strike price is always technology specific (i.e. wind, solar, biomass) and the combination of the overall remuneration with a market price and a top up to the strike price is also very transparent from a public point of view, enabling to differentiate between a supported and market underpinned element of the remuneration for the renewable projects.

The open issue remains the power balancing to be provided as a part of the contractual set up – if such service is not part of the PPA, the investor has two options: either to provide them internally (i.e. trading prediction etc.) or to outsource to a third party, through different products (i.e. market access only, balancing costs contracting etc.).

Banks’ point of view

A crucial question in the end is the impact of the bidding structures on the project financing options as most of the investments require external debt for funding. For the banks, the auctioning mechanisms are an acceptable way of structuring investments. However, some basic requirements are sought in order to achieve bankable structures: i) the projects are required to conclude a PPA and solve balancing risk; ii) long term solutions are sought (ideally matching the maturity of the financing); iii) renewable generators and banks are contracting with power traders and here the credit rating of counterparties is also an issue; iv) the question of an off-taker of last resort in case the private party is not performing is always to be considered to create a more robust structure for any potential disruptions.

Recent experience with auctions

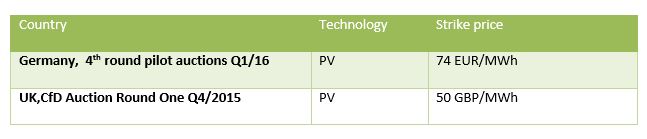

The result of the recent auctions in countries where the auctioning mechanisms have already been implemented is quite encouraging (although currently only with a limited capacity being auctioned) and it is significantly below the FiT support witnessed in many European countries in the past:

Table 2: Strike price for PV in Germany and UK

There are also possible downsides and concerns linked with auction schemes. It is many times interpreted that large investors will benefit from the auctions, who can utilize economies of scale, or that the aggressive strike price bidding will create a situation with projects hardly profitable on the investors side discouraging from investments and high upfront costs of preparing for an auction and losing by a slim margin (the case voiced in the DE pilot auctions). These however would have to be substantiated by practice and current indications are not providing sufficient evidence. From the financing institutions perspective the credit approval process tends to be a very intricate and time-consuming process. Funding certainty for a transaction can only be provided after thorough due diligence and analysis – this way the binding nature of the auction results and financing certainty prior to entering the auction are in a timing conflict at minimum.

To conclude, from numerous perspectives auctions are currently seen as the future in respect of support of renewables – the winners will be the best sites, lowest costs and right tools to de-risk the projects to achieve an optimal funding structure lowering the financing costs and increasing leverage. Possible downsides are best to be managed by predictable, transparent and frequent enough auctions.

The increased complexity of the new scheme for the project proponents including financing institutions should be acknowledged by the policy makers (i.e. by readiness to step in through direct contracts, creating an off-taker of last resort for the power sold under the PPA) as a price for the benefits of the mechanism.

Be the first one to comment on this article.