Photo: Pixabay

By Qendresa Rugova, Burg Capital GmBH, Vienna

esa.rugova@burgcapital.com

Global investment in renewable power has seen impressive growth, even surpassing anticipations with a total investment of USD 270.2 billion in 2014, 17% higher than 2013 (BNEF, 2015). This surge in investment has become possible as costs for solar panels and wind turbines are rapidly decreasing thereby making renewable technologies more competitive relative to conventional power generation.

Balkan countries, with their vast untapped renewable energy potential, have adopted obligatory binding targets for renewable energy, but have struggled to mobilize capital to fund and bring projects to fruition. It is estimated that EUR 2.3 billion is required to finance regional renewable projects of common regional interest (Energy Community, 2013). Restricted by public budgets, state-owned incumbent utilities are unable to finance such projects on their own balance sheets, thus creating opportunities for private sector independent power producers (IPPs) to bridge the funding gap. However, attracting investors has proven to be rather difficult as national energy markets do not yet provide for stable, transparent regulatory frameworks and a competitive environment for such investments. Moreover, national markets are considered to be small on an individual basis which limits potential for economies of scale.

Balkan countries, with their vast untapped renewable energy potential, have adopted obligatory binding targets for renewable energy, but have struggled to mobilize capital to fund and bring projects to fruition.

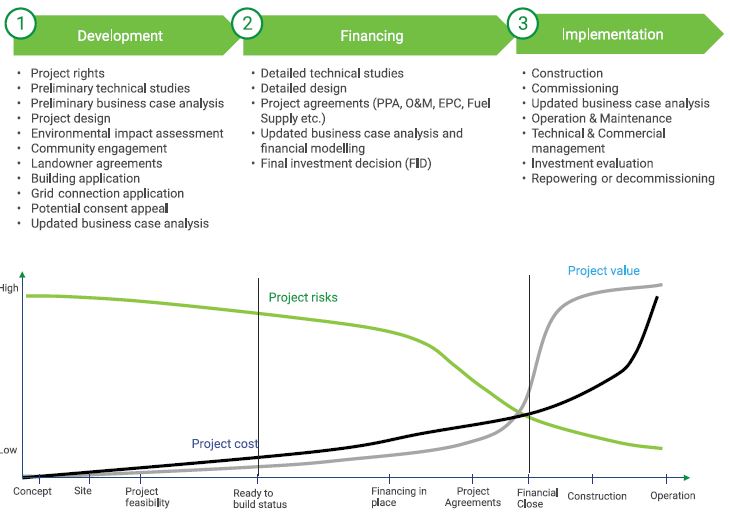

Renewable energy projects essentially go through three distinct phases: development, financing and implementation. A combination of both equity and debt is required for renewable projects, with equity sponsors being instrumental in driving projects through the first two phases. As each phase is completed and the project de-risked by the structuring and development work, project values increase and they become more attractive for equity investors and lenders alike (Figure 1).

Figure 1 – Renewable energy projects, implementation phases, value creation and risk profile – Source: Burg Capital analysis

Initial development funding in the Balkans is usually sourced from either local developers or international renewable project developers with a local or regional presence. There has been some progress in project planning activities throughout the region (Phase 1), however challenges remain to structuring complete bankable solutions to attract non-recourse project financing (Phase 2).

Sourcing debt for renewable projects requires use of internationally tested financing structures, such as project finance, which are designed to suit the long term nature of infrastructure projects in heavily regulated industries, such as energy. In such structures, project debt (typically covering up to 70% of total cost) is issued entirely on the basis of the project as a stand-alone activity with repayment entirely dependent on the future cash flow of the project and with limited or no recourse to the ultimate project owners.

Permitting-related risks are especially important to equity investors who require clarity to be able to commit to developing renewable projects in any particular market.

Non-recourse debt relies on a robust contractual structure allowing for major risks (regulatory, offtake, operational, construction, fuel supply etc.) to be mitigated often by a pass-through to third parties via project agreements – power purchasing (PPA), engineering, procurement and construction (EPC), operation and maintenance (O&A), leasehold agreement etc., so as to give the necessary comfort to the investors and financiers that the project is indeed viable and bankable.

Following are some of the main obstacles holding back renewable developments in the Balkan region:

Limited institutional capacities and project development know-how

Commercial structuring and financing of energy projects (Phase 2) is a lengthy and detailed process as it requires expertise in a number of disciplines (technical, legal, financial and environmental). This is particularly important for the renewable industry given its dynamics in terms of capital cost reductions, financial innovation, technological advancements in efficiency, system integration and storage, among other factors.

Expertise is often missing, both on institutional and project development levels, which hinders implementation of targets.

Such expertise is often missing in the Balkans, both on institutional and project development levels, which hinders implementation of renewable targets in terms of speed and scale. This is particularly important given the recent trend of incumbent utilities eyeing expansion in domestic renewable sector (Macedonia, BiH), which may further delay implementation (given financial limitations on public companies) and also prevent transfer of know-how from other more developed markets for renewable energy.

Cumbersome permitting processes

The permitting process in the Balkan region is considered to be cumbersome and opaque often involving multiple authorities. Despite existing renewable legislation, secondary legislation, such as one pertaining to grid access and connection costs, is often absent and need to be addressed in order for laws to become operational. This creates an information gap as to the necessary steps required to bring projects to a ready-to-build status. Furthermore, permitting and licensing procedures do not always distinguish between small scale and utility-size projects, subjecting small developers (such as rooftop solar developers) to the lengthy and costly administrative procedures.

Permitting-related risks are especially important to equity investors who require clarity to be able to commit to developing renewable projects in any particular market. It is usually such regulatory obstacles that discourage investors from investing in the region and, conversely, to favor others in the global competition to attract capital. It is therefore important that administrative and regulatory processes are streamlined and properly communicated to stakeholders.

Reliability and stability of regulatory support schemes

Renewable technologies continue to be dependent on support schemes to ensure long-term cash flow stability in terms of preferential pricing for renewables and guaranteed priority offtake enforced through power purchase agreements (PPAs). Support schemes should ensure a stable, efficient and balanced support for renewables (given the decreasing cost of solar panels and wind turbines) with limited impediments on public spending. Any sudden material policy change should be avoided as it can be detrimental to further industry development. Recent reverse policy actions for renewables in Romania, Bulgaria have made investors and financiers wary of such change-in-law risks, with some investors being forced to cancel uneconomic projects in the absence of such support.

Secondary legislation, such as one pertaining to grid access and connection costs, is often absent.

Priority access and mandatory power offtake is also of significant importance as it manages volume risk. Mandatory offtake should be guaranteed for the entire project lifetime or alternatively projects should be allowed to access wholesale power markets or to enter bilateral agreements with third parties. Such obstacles are currently being faced by small-scale solar projects (less than 1 MW) in Turkey, for example, as the mandatory offtake risk post feed-in-tariff (FIT) period is not explicitly guaranteed in the regulations.

Limited creditworthy parties for Offtake, EPC, O&M, Fuel Supply

As previously mentioned, project finance structures require robust project agreements to allow for risks to be transferred to those parties that are best able to manage them. However, it is challenging to conclude bankable agreements with strong, creditworthy counterparties able to undertake and deliver on those agreements. Such limitations are typical in all key areas i. e. power offtake, EPC companies, O&M providers and fuel suppliers (for biomass and biogas plants). Offtake challenges, for example, have been experienced in Albania as the national power company KESH faced difficulties in meeting its obligations to renewable generators.

Limitations on the availability of creditworthy counterparties make it difficult to anticipate and guarantee long-term stability in terms of price and quality. The long-term aspect is particularly important as investors and lenders need to rely on the fact that such parties will be in the market for the life of the project.

Despite challenges, progress is underway

The Balkan region has made significant strides forward in incorporating renewable targets in respective national strategies and implementing a number of initial renewable projects. Despite limitations on funding sources, multilateral financing institutions (MFIs) like the European Bank for Reconstruction and Development provide lending facilities for renewable financing as well as technical assistance programs designed to assist developers in achieving bankable projects and to serve as a catalyst for private sector financing. Furthermore, the Energy Community Secretariat is making significant efforts to encourage and foster inter-regional cooperation and coordination in terms of market design and policymaking for a successful promotion of renewable projects, and policymakers appear to be increasingly oriented towards improving the local regulatory environment to attract foreign direct investment. Based on these trends, all indications are that the current challenges will be overcome, allowing the region to unlock its significant potential for renewable energy.

Burg Capital is corporate & project finance advisory practice focused on the energy sector with comprehensive experience across all generating technologies.

References:

- BNE Intellinews, Winds change for renewable energy in Southeast Europe, April, 2015

- EBRD, ’What is missing to finance renewable energy projects?’, June, 2014

- Energy Community Secretariat, Annual Implementation Report, 2013

- Global trends in Renewable Energy Sources, Bloomberg New Energy Finance, 2015

- Irena – Executive Strategy Workshop on Renewable Energy in South East Europe. Background Paper Topic B, Practical Policies for Financing Renewable Energy Action Plan Investments