Photo: Pixabay

This article is a reprint of content originally published on fitchsolutions.com on January 17, 2019. The reprint is published with express written consent from Fitch Solutions.

![]()

Fitch Solutions: Turkey’s decision to delay its 1 gigawatt (GW) solar capacity tender in January affirms our view that growth in the country’s non-hydropower renewables sector will slow over 2019/2020, as projects development stalls in the near-term due to financing challenges.

Key View:

- We forecast wind and solar capacity additions growth in Turkey to slow over 2019/2020, as a number of projects will face delays amid the country’s challenging economic environment. In particular, the depreciation in the lira from August 2018, and the ensuing volatility registered for the currency, will mean that obtaining financing will be challenging for a number of developers

- The decision in January to postpone Turkey’s 1GW solar capacity tender due to reported financing challenges affirms this view, and we see elevated risk that Turkey’s 1GW wind power tender – scheduled for March – could face similar hurdles.

- We remain optimistic on long-term growth in Turkey’s renewables sector, however, as renewable energy deployment will remain a key priority for the Turkish government as it seeks to diversify its power sector in an attempt to reduce gas feedstock imports.

Turkey’s decision to delay its 1 gigawatt (GW) solar capacity tender in January affirms our view that growth in the the country’s non-hydropower renewables sector will slow over 2019/2020, as projects development stalls in the near-term due to financing challenges. Following the steep deprecation in the lira from August 2018, we had already revised down our wind and solar capacity forecasts as we expected project developers to struggle to gain financing for their projects in a challenging economic environment.

Solar surge to end, wind to slowly recover

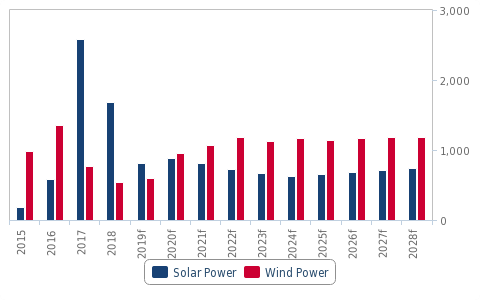

Turkey – Net Annual Capacity Additions By Technology, MW

f = Fitch Solutions forecast. Source: EIA, Irena, Fitch Solutions.

The ensuing currency volatility and rising interest rates has cemented the issue of financing, culminating in the solar capacity tender delay after a majority of the companies participating in the tender reportedly asked for more time to secure financing. We highlight that the country’s onshore wind power capacity tender – scheduled for March 2019 – could also face delays due to financing complications. That said, the onshore wind power sector has a more established domestic equipment manufacturing supply chain than that of the more nascent solar sector, which could anchor more investor confidence. For more nascent renewables sectors, Turkey’s economic woes will dampen investor interest, and we highlight that no announcement has been made following the offer submission deadline on October 23 2018 for the country’s 1.2GW offshore wind tender. The capital intensity of offshore wind projects coupled with Turkey’s limited offshore wind equipment manufacturing supply chain leads us to expect the offshore wind sector to be on the backburner for now.

The uncertainty over when renewables tenders will be implemented feeds into our our cautious 2019 forecast for Turkey’s wind and solar sectors, as we only forecast 600MW and 800MW to be added for the wind and solar power sectors respectively. While the wind sector slowdown already kicked in over 2018 due to a shrinking project pipeline, when about 540MW was added, we estimate than 1.7GW of solar capacity was added over 2018.

Long-Term Outlook

- Solar Power: The slowdown in solar power capacity additions will be somewhat mitigated by our expectation that the first tranches of the 1GW Karapinar solar power facility – which was tendered in 2017 – will be installed over 2019 (see ‘Project-Specific Auctions To Drive Renewables Growth, August 8 2017). This will offset some of the slowdown in growth we expect for unlicensed projects with a capacity of 1MW or less, which has dominated Turkey’s solar sector to date, following cuts to the feed-in-tariff and increasing grid connection costs for these projects. Over the longer-term, we maintain that capacity auctions will drive continued growth in the solar sector. We forecast installed solar capacity to increase from the estimated 5.1GW installed as of end-2018 to 12.4GW by 2028.

- Wind Power: Similarly to the solar sector, the wind power sector will be buoyed by the 1GW wind energy project awarded to a consortium Siemens-Gamesa and Turkerler and Kalyon in 2017. This leads us to expect with growth in wind power capacity growth to accelerate from 2020, following a slump over 2018/19. Furthermore, a total of 2,110 MW of preliminary licenses awarded to a a number of project developers at the end of 2017, which support longer-term growth in the wind power sector, despite our expectation that a number of these projects are likely to face the aforementioned near-term delays in the Turkey’s volatile economic environment. Over the longer term, we maintain that Turkey’s wind capacity auctions will generate will drive the country’s wind capacity expansion, with total capacity increasing from an estimated 7.4GW as of end-2018 to 18.2GW by 2028.

Be the first one to comment on this article.